Investment property lending in Colorado is a vital segment of real estate finance, promoting economic growth by facilitating the acquisition of commercial and residential properties. Lenders must adeptly assess risk, considering occupancy rates, market trends, property values, and borrower creditworthiness. Colorado's diverse landscape and fluctuating economy necessitate staying informed about regional dynamics to maintain a stable investment property market. A robust network of lenders, including traditional banks, specialized companies, and credit unions, offers competitive interest rates, flexible terms, and personalized service, enhancing accessibility for investors. Evaluating lenders should focus on local expertise, consistent service history, diverse product offerings, and transparent terms, ensuring tailored financing solutions for Colorado's vibrant investment property market. Building and maintaining this network through strategic relationships, industry events, and staying informed about market trends is crucial for success.

“Unleashing Investment Potential: The Power of Lender Networks in Colorado

In the vibrant landscape of Colorado’s real estate market, understanding investment property lending is key to unlocking lucrative opportunities. This article delves into the significance of a robust network of lenders, exploring how it facilitates access to financing for ambitious investors. We dissect the role of these networks, their benefits, and provide insights into the top players shaping Colorado’s mortgage market. Learn criteria for evaluating lender alliances and discover strategies to build and maintain reliable connections for successful investment property lending.”

- Understanding Investment Property Lending in Colorado

- The Role of a Strong Network of Lenders

- Benefits of Working with Multiple Lenders

- Key Players in the Colorado Mortgage Market

- Criteria for Evaluating Lender Networks

- Strategies to Build and Maintain a Reliable Network

Understanding Investment Property Lending in Colorado

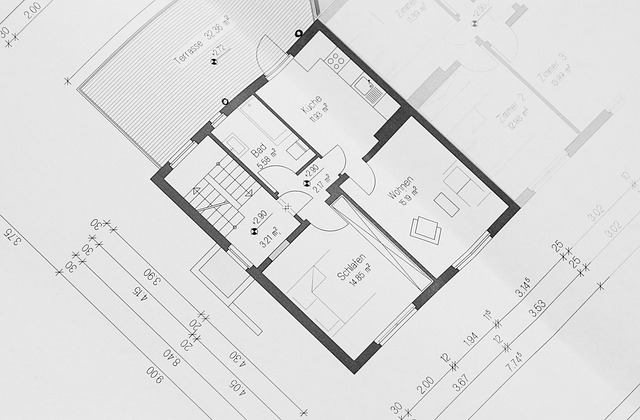

Investment property lending in Colorado is a specialized sector within the broader real estate finance market, catering to individuals and entities seeking to invest in commercial or residential properties within the state. This type of financing plays a vital role in fostering economic growth by enabling potential investors to acquire assets that can generate passive income or appreciate over time. The unique landscape of Colorado presents both opportunities and challenges for lenders due to its diverse real estate market, ranging from vibrant urban centers like Denver to the more rural areas in the mountains.

Lenders offering investment property loans in Colorado must be adept at assessing risk associated with various property types and locations. They consider factors such as occupancy rates, local market trends, property values, and borrower creditworthiness. Given the state’s economic fluctuations and varying real estate cycles, lenders need to stay informed about regional dynamics to make sound lending decisions. This ensures a robust network of investors who can access capital for their ventures while maintaining stability and growth in Colorado’s investment property market.

The Role of a Strong Network of Lenders

A robust network of lenders plays a pivotal role in the landscape of investment property lending in Colorado, fostering a dynamic and competitive market. This network consists of various financial institutions, each bringing unique strengths and expertise to the table. From traditional banks to specialized mortgage companies, this collective offers a wide array of loan products tailored to cater to diverse investor needs. The presence of such a network enhances accessibility for prospective property owners, ensuring they have multiple options to explore.

For investors in Colorado’s thriving real estate market, a strong lender network provides numerous benefits. It enables borrowers to secure competitive interest rates, flexible loan terms, and personalized service. Moreover, it allows for faster processing times, as these lenders often work collaboratively, streamlining the application and approval process. This efficiency is particularly advantageous for those seeking to capitalize on lucrative investment opportunities in the state’s vibrant real estate scene, whether it’s through purchasing a rental property or refinancing an existing portfolio.

Benefits of Working with Multiple Lenders

Working with multiple lenders for investment property lending in Colorado offers numerous advantages. One of the key benefits is access to a wider range of loan options and competitive rates. Unlike relying on a single lender, having multiple choices allows borrowers to compare terms, interest rates, and repayment conditions. This ensures that investors can secure the most favorable financing for their properties, whether it’s a residential rental or a commercial space.

Diversifying lenders also provides protection against potential risks. If one lending institution tightens its loan criteria or increases interest rates, having alternative options can mitigate these changes. It offers borrowers flexibility and negotiating power, enabling them to secure the best terms for their investment property lending in Colorado.

Key Players in the Colorado Mortgage Market

In the dynamic landscape of Colorado’s mortgage market, a strong network of lenders plays a pivotal role in facilitating both residential and investment property lending. Key players include a diverse range of financial institutions, from traditional banks to specialized mortgage companies and credit unions. These entities cater to a wide array of borrower needs, offering various loan products tailored for primary residences, second homes, and investment properties alike.

Colorado’s robust real estate market has attracted numerous lenders who recognize the potential for lucrative investment property lending opportunities. With a focus on both local and national markets, these lenders provide specialized services designed to meet the unique demands of investors. From fixed-rate mortgages to adjustable-rate loans and jumbo financing options, the competitive landscape ensures borrowers have access to favorable terms and rates, fostering continued growth in Colorado’s vibrant investment property market.

Criteria for Evaluating Lender Networks

When evaluating a network of lenders for investment property lending in Colorado, several key criteria come into play. Firstly, consider their experience and expertise in the local market, especially within the realm of investment properties. Lenders with a deep understanding of Colorado’s real estate trends, zoning laws, and market dynamics are more likely to offer tailored financing solutions. Look for networks that have been serving the state consistently, indicating a strong relationship with local brokers and investors.

Additionally, assess their product offerings and flexibility. A robust network should provide a diverse range of lending options, including conventional loans, jumbo loans, and specialized programs designed for investment properties. They should be able to cater to various borrower profiles, whether first-time investors or experienced landlords. Reputable networks often boast transparent terms, competitive interest rates, and flexible repayment options, ensuring investors receive favorable lending conditions tailored to their property acquisition goals in the vibrant Colorado market.

Strategies to Build and Maintain a Reliable Network

Building and maintaining a strong network of lenders is crucial for anyone involved in investment property lending in Colorado. One effective strategy is to foster relationships with various financial institutions, including banks, credit unions, and specialized mortgage lenders. Regular communication and collaboration can help establish trust and ensure access to a diverse range of financing options tailored to different investment scenarios. Attending industry events, joining professional networks, and seeking referrals from peers can also expand your reach.

Additionally, staying updated on market trends and regulatory changes is essential. By being knowledgeable about the latest in investment property lending, you can better align your network’s offerings with current demands. Offer value-added services like consulting and educational resources to lenders, encouraging long-term partnerships. Consistent performance and strong reputation within the industry will attract more lenders interested in collaborative opportunities, enhancing the reliability of your network for both borrowing and lending needs in Colorado’s vibrant investment market.

In conclusion, a robust network of lenders is pivotal for navigating the complex landscape of investment property lending in Colorado. By leveraging multiple financial institutions, investors can access a wider range of loan options tailored to their unique needs. This strategic approach not only enhances borrowing flexibility but also ensures competitive rates and personalized service. As the Colorado mortgage market evolves, building and maintaining strong lender partnerships is key to staying ahead in the game of investment property financing.